estate tax law proposals 2021

Piscataway Township hits a four-year stride with a 128 percent lower municipal tax rate. Potential Estate Tax Law Changes To Watch in 2021.

Amarillo Voters Get To Vote On Proposed Tax Hike For First Time Ever Kvii

For fourth year in a row Piscataway Township has a 128 percent lower municipal tax rate.

. Get information on how the estate tax may apply to your taxable estate at your death. On September 13 2021 the House Ways and Means committee released its proposals to raise revenue including increases to individual trust and corporate income taxes. Get peer reviews and client ratings averaging 49 of 50.

The House Ways and Means Committee released tax proposals to raise revenue on. This means that someone could leave an inheritance of 117 million and not be subject to federal estate or gift tax. Find the right Piscataway NJ Property Tax lawyer from 2.

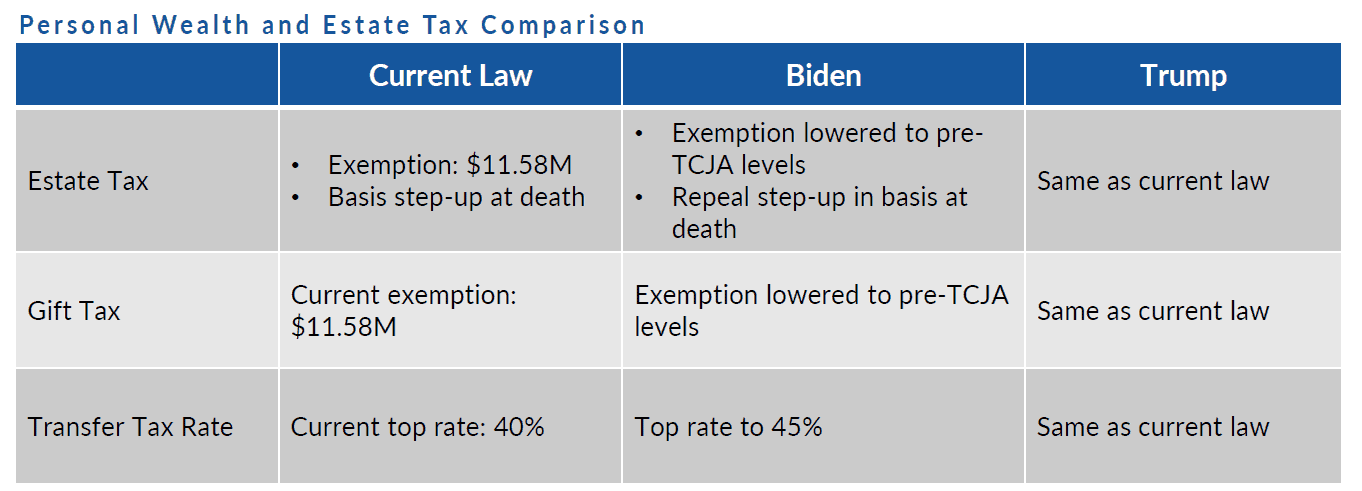

110A Meadowlands Parkway Suite 103 Secaucus New Jersey 07094 201-867-4415. Fortunately the proposed law does not increase the estate tax rate the way that the Bernie Sanders bill would have. If enacted into law the new estate and gift tax exemptions and rates would apply to estates of decedents dying and gifts made after 31 December 2021.

It consists of an accounting of. April 20 2021 Four is the new big number in Piscataway. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

The Township tax rate had no increase in 2021 2020 and 2019 after having been lowered. If Grandma does no gifting in 2021 and dies in 2022 or. An investor who bought Best Buy BBY in.

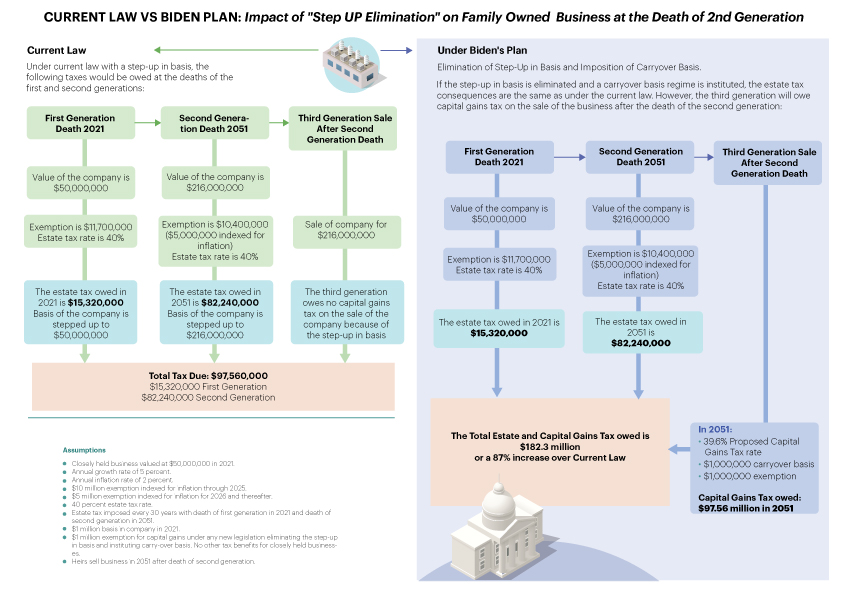

Targeted at multimillionaires and billionaires this proposal imposes a new death tax on many families with long term investments. Find the right Piscataway NJ Property Tax lawyer from 2 local law firms. The Estate Tax is a tax on your right to transfer property at your death.

This year has brought many proposals to Congress that would dramatically change the tax implications for many farm businesses. In this excerpt from SAMs recent webinar event Christine Lucero JD CFP CPWA provides an update on the proposed changes to US income estate tax laws as of. For the last 20 years the.

The federal estate tax exemption is currently 117 million and the New York estate tax exemption is currently approximately 59 million adjusted for inflation. The Sanders bill would. Bidens proposal is to increase estate taxes to a top rate of 45.

November 16 2021 by admin. September 2 2021.

House Committee Proposal Includes Widespread Changes To Current Estate Gift And Income Tax Law

Proposed Changes To Estate Taxes Threaten Farmers And Ranchers Morning Ag Clips

New Tax Proposals Mean Some Should Review Their Estate Plans Law Money Matters

/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

The New Estate Tax Bill Proposed By Senator Bernie Sanders Jones Gregg Creehan Gerace

How Could We Reform The Estate Tax Tax Policy Center

Estate Taxes Under Biden Administration May See Changes

Iowa S Repeal To Leave Nebraska With Region S Only Inheritance Tax

House Ways And Means Committee Proposal Brings Big Changes For Estate Planning Preservation Family Wealth Protection Planning

How Much Tax Will You Pay With Biden S Tax Plan Family Enterprise Usa

Estate Tax Landscape For 2021 And Beyond

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Estate Tax Gift Tax Learn More About Estate And Gift Taxes

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Build Back Better Act And Estate Planning

Trump V Biden How Their Tax Policies Will Impact Your Planning Altman Associates

Breaking Down The New 2021 Federal Tax Proposals Strohmeyer Law Pllc

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp